Posted on: October 26, 2024, 10:22h.

Last updated on: October 26, 2024, 11:52h.

According to Canadian Gaming Association President and CEO Paul Burns, Ontario financial numbers for Q2 FY 2024-25 show a market that’s “matured”.

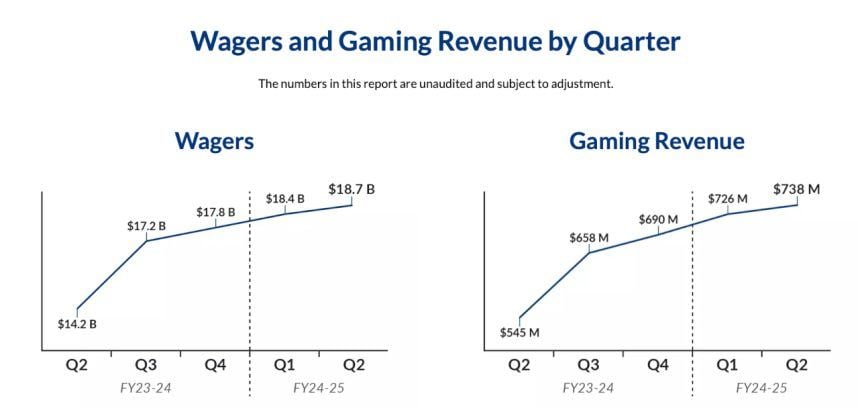

The latest iGaming Ontario market performance report was released on Thursday. Total wagers in Q2 ($18.7 billion) were up by 1.6% compared to Q1 – and 31.7% compared to Q2 2023-24.

Ontario Wagers Increase

Total gaming revenue in Q2 Ontario was $738 million, a 1.7% increase compared to Q1 and a 35.4 per cent year-over-year increase.

The open, competitive Ontario igaming market launched in April 2022. The financial results do not include revenues generated via the government-owned Ontario Lottery and Gaming Corporation platform.

“Following a tradition, she established when the market first opened, [iGaming Ontario] Executive Director Martha Otton gave attendees at her panel at G2E [earlier this month, in Las Vegas] a sneak peek at iGaming Ontario’s Q2 2024 numbers,” Burns said. “These results show what we hoped would happen with the market – operators have hit their stride, advertising is levelling off, and AGCO and iGO are still admitting more operators into Ontario to replace the handful that have left.

CGA President: Operators Have Hit Their Stride

Overall numbers are now more representative of a mature market versus a new one, and it points to long-term sustainability for both the province and the industry.”

The market performance report covered July 1 to Sept. 30, 2024. Gaming revenue is the total cash wagers including rake fees, tournament fees and other fees from all operators minus player winnings from cash wagers, not taking into account operating costs or other liabilities.

In Q2, there were 51 operators and 83 licensed gaming websites with activity. There were more than 1.32 million active player accounts in Q2, down from 1.9 million active player accounts in Q1, and the average monthly spend per active player account was $308 (that number was $284 in Q1).

Casino Segment Dominates

Casino (slots, live and computer-based table games, peer-to-peer bingo) continues to dominate the Ontario market – 86% of total wagers ($16 billion), and 75% of gaming revenue ($553 million).

Betting on sports, esports, proposition and novelty bets was 12% of total wagers ($2.2 billion), 23% of gaming revenue ($167 million). Peer-to-peer poker was at 2.2% of total wagers ($417 million), 2.4% ($18 million) of revenue.

Meanwhile, Alberta continues to work on launching an Ontario-style igaming regulatory regime, some time in 2025.

Source link